Is It Easy to Get Approved for a Fidelity Options Account

The StockBrokers.com best online brokers 2022 review, our 12th annual, took three months to complete and produced over 40,000 words of research. Here's how we tested. Our editorial content is independent and unbiased; here's how we make money.

Options trades offer online brokers much higher profit margins than stock trades, and, as a result, competition is fierce in attracting clients. This type of market atmosphere is great for traders because healthy competition drives product innovation. Every broker strives to offer the best platform for options trading.

For our 2022 Review, we tested and scored 15 different trading platforms. Alongside platform usability, our testing focused on options chains (e.g., optional views, total optional columns, streaming data quality, total greeks offered), options analysis (e.g., P&L charts, calculators), and option position management (e.g., if Greeks stream, rolling functionality, grouping availability, and advanced position analysis). With most brokers offering similar pricing, trade cost was not an influencing factor in our scoring.

Best Options Trading Platforms 2022

Here are the best options trading platforms, based on over 30 variables.

- TD Ameritrade - Best overall options trading platform and tools

- E*TRADE - Best web-based options trading platform

- Interactive Brokers - Best for professional options traders

- Fidelity - Best for beginners

- TradeStation - Best options platform technology

Other options trading platforms tested

In addition to our top five trading platforms for options in 2022, we reviewed 10 other brokers: Ally Invest, Charles Schwab, Firstrade, J.P. Morgan Self-Directed Investing, Merrill Edge, SoFi Invest, Tradier, Robinhood, Vanguard and Webull. To dive deeper, read our reviews. (Not all brokers currently offer options trading.)

Where can I practice options trading?

To practice options trading, choose an options trading platform that offers a free paper trading account. With paper trading, virtual money is used to place options trades in a simulated environment. E*TRADE, TD Ameritrade, TradeStation, and Interactive Brokers all offer paper trading for options.

Options trading platform tools comparison

Here's a summary of the primary options trading features offered by the best options trading brokers. See the end of this guide for a definition of each feature.

| Feature | TD Ameritrade | E*TRADE | Interactive Brokers Visit Site |

| Option Chains - Basic View | Yes | Yes | Yes |

| Option Chains - Strategy View | Yes | Yes | Yes |

| Option Chains - Streaming | Yes | Yes | Yes |

| Option Chains - Total Columns | 35 | 31 | 37 |

| Option Chains - Greeks | 5 | 5 | 4 |

| Option Positions - Greeks Streaming | Yes | Yes | Yes |

| Option Chains - Quick Analysis | Yes | Yes | Yes |

| Option Analysis - P&L Charts | Yes | Yes | Yes |

| Option Probability Analysis | Yes | Yes | Yes |

| Option Probability Analysis Adv | Yes | Yes | Yes |

| Option Positions - Greeks | Yes | Yes | Yes |

| Option Positions - Adv Analysis | Yes | Yes | Yes |

| Option Positions - Rolling | Yes | Yes | Yes |

| Option Positions - Grouping | Yes | Yes | Yes |

Options trading platform pricing comparison

Here's a summary of the pricing for the best options trading brokers.

| Feature | TD Ameritrade | E*TRADE | Interactive Brokers Visit Site |

| Minimum Deposit | $0.00 | $0.00 | $0.00 |

| Stock Trades | $0.00 | $0.00 | $0.00 |

| ETF Trade Fee | $0.00 | $0.00 | $0.00 |

| Mutual Fund Trade Fee | $74.95 | $19.99 | $14.95 |

| Options (Base Fee) | $0.00 | $0.00 | $0.00 |

| Options (Per Contract) | $0.65 | $0.65 | $0.65 |

| Futures (Per Contract) | $2.25 | $1.50 | $0.85 |

| Broker Assisted Trade Fee | $25.00 | $25.00 | $30.00 |

Best options trading platform tools

TD Ameritrade took the top spot in this year's review for platform and tools and was close behind in virtually every other category. This shines through especially in its options trading. The thinkorswim platform, both as a desktop platform and on mobile, provides all that you could want for successful options trading, including vast customization, incredible tools and great education. Strategy Roller from thinkorswim enables clients to create custom rules and roll their existing options positions automatically.

TD Ameritrade thinkorswim options trade profit loss analysis.

Our other winners also offer excellent platforms. Web-based Power E*TRADE offers all the tools an options trader could want, and displays them in magnificent form. Attention to detail, such as automatic spread groupings, effortless scanning through StrategySEEK, and easy-to-understand risk/reward data through tradeLAB make Power E*TRADE a truly unique experience.

Power E*TRADE options trading platform Snapshot Analysis tool.

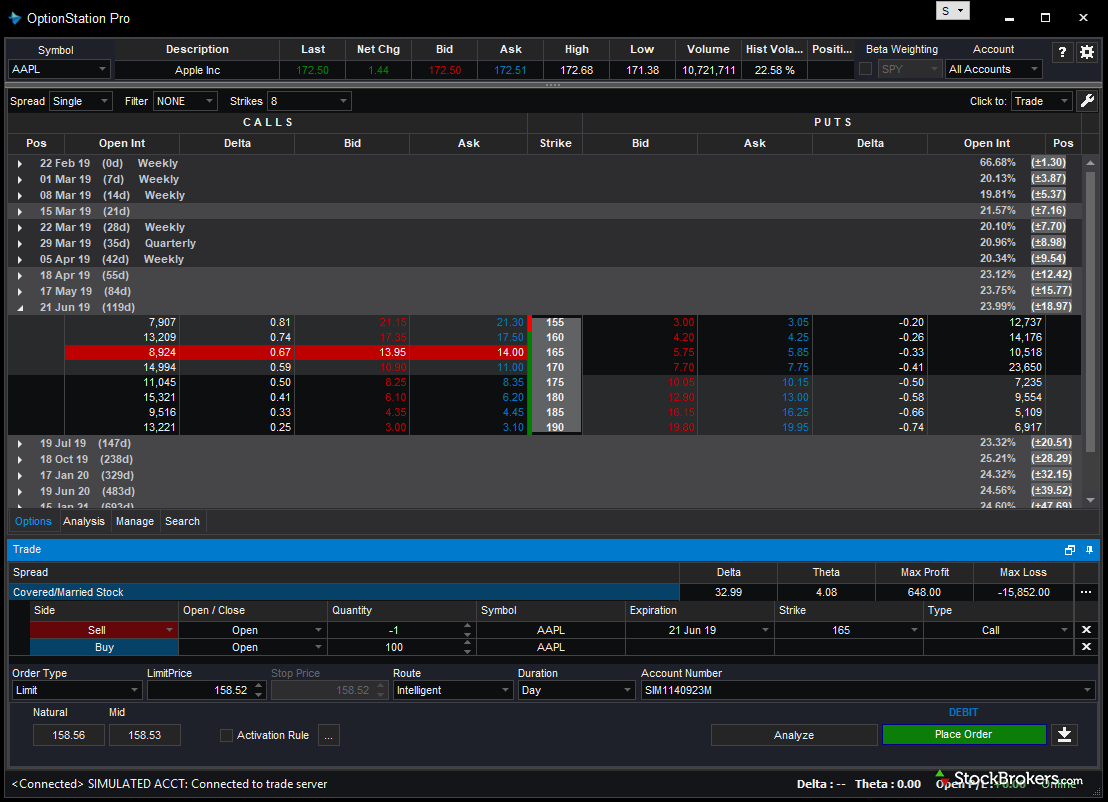

TradeStation's OptionsStation tool makes analyzing potential trades a breeze, and even goes as far as including 3D P&L charts. Investors note, however: While it's visually appealing, we did not see any distinct advantage over a traditional 2D P&L chart. 3D charts aside, no question, TradeStation earns its spot as one of the best platforms for options trading in 2022.

Best options trading platform TradeStation OptionStation Pro.

For professionals, Interactive Brokers takes the crown as the best options platform. There is no base charge, and the per-contract rate is just $0.70. Additional savings are also realized through more frequent trading. That said, Interactive Brokers requires a $110,000 minimum deposit for margin accounts. Lastly, its trading platform, Trader Workstation, is the most challenging platform to learn out of all the brokers we tested for our 2022 review.

Interactive Brokers Trader Workstation TWS options trade analysis.

Fidelity was our top pick for 2022 for both research and education. With its offerings and support, it also came out on top for beginners. Fidelity's commitment to an excellent client experience shines through in all it does, including options trading. Tools like the Option Builder and options scanner, great data including option statistics, and solid education for options traders put Fidelity on our winners list.

Fidelity Active Trader Pro platform.

There's a healthy variety of reputable brokers to choose from in the world of options trading. At a minimum, investors should expect their broker to include scanning, P&L analysis, risk analysis, and easy-order management. Position management functionality and tying the experience together is where platforms such as thinkorswim by TD Ameritrade and Power E*TRADE distinguish themselves.

Which trading platform is best for options?

The best trading platform for options trading in 2022 is TD Ameritrade. For beginners, the TD Ameritrade platform offers the right balance of ease of use, education and functionality. The ability to visualize option positions and adjust Greeks is invaluable, and there is good reason that thinkorswim is the go-to platform for many top options traders.

Is Robinhood good for options trading?

While Robinhood is easy to use, it lacks the trading and research tools that the best options trading platforms offer. In addition to a limited selection of options education articles, Robinhood also does not offer paper trading, so there is no way to practice trading options with fake money. Thus, for beginner options traders, we do not recommend Robinhood.

Which broker has free options trading?

Free options trading is like free stock trading. It has some associated costs, like payment for order flow, or PFOF. While many brokers no longer charge commissions on options trades, almost all charge per-contract fees (including some brokers who claim to have "free" options trading). The exceptions are Robinhood, SoFi Invest, Firstrade and Webull, which charge no commissions or fees for options.

What is a call option?

In its most basic form, a call option is used by investors who seek to place a bet that a stock will go up in price. Buying a call option contract gives the owner the right (but not the obligation) to purchase shares at a pre-specified price for a predetermined length of time. As the stock price goes up, so does the value of each option contract the investor owns. Conversely, if the stock price goes down, so does the value of the call option. Each contract represents 100 shares of stock.

What is a put option?

In its most basic form, a put option is used by investors who seek to place a bet that a stock (or other security such as an ETF, commodity, or index) will go down in price. Buying a put option gives the owner the right (but not the obligation) to sell shares of stock at a pre-specified price (strike price) before a preset date (expiration). The further the stock falls below the strike price, the more valuable each contract becomes. Alternatively, an increase in the stock price will decrease the value of the put option.

How much money do you need for options trading?

Each online broker requires a different minimum deposit to trade options. For most brokerages, the minimum deposit required is less than $1,000 for level 1 options trading. Certain options strategies, such as net-credit spreads, can require as much as $10,000 available in your account and are considered level 2 or level 3. To apply for options trading approval, investors fill out a short questionnaire within their brokerage account.

Can I trade options with $100?

Could you? Yes. But trading with $100 is not a good path to success. Most individual options cost more than $100. For instance, with the XLF ETF, a low-priced ETF, trading at just $39, one 30-day at-the-money call costs $90. An option covers 100 shares of stock, so if the listed price is $0.92 the total cost of the option will be $92 + any contract fees or commissions. Buying cheap out-of-the-money options is an almost guaranteed way to lose your $100.

Is options trading risky?

Yes. Options trading is a form of leveraged investing and thus is inherently risky. Any time an investor is using leverage to trade, they are taking on additional risk. Many times, this risk is unforeseen and not easily quantified.

On the most basic level, investors who buy a call or put option are only risking the money they invested in the contract. However, when selling a call or put, if the trade isn't protected (also known as going naked), the investor is taking on potentially unlimited risk.

As a protective measure, there are five options approval levels, and each one requires an application through the online broker platform to unlock. The riskier the options strategy, the higher the approval needed to trade it.

Options trading platform features summary

All of the best brokers for options trading offer the following features.

| Feature | Definition |

|---|---|

| Has Education - Options | Provides a minimum of 10 educational pieces (articles, videos, archived webinars, or similar) with the primary subject being options. All content must be easily found within the website's learning center. Platform tutorials, FAQs, etc. do NOT count. |

| Option Chains - Streaming Real-time | Option chains with streaming real-time data. |

| Option Chains - Greeks Viewable | When viewing an option chain, the total number of Greeks that are available to be viewed as optional columns. Greeks = delta, gamma, theta, vega, rho. |

| Option Chains - Quick Analysis | The ability to jump straight from the option chain to a P&L chart or probability chart for deeper analysis. Viewing a summary P&L within the chain itself also qualifies. |

| Option Analysis - P&L Charts | When analyzing a theoretical option trade, a P&L chart is available. |

| Option Analysis - Probability Analysis | A basic probability calculator. |

| Option Analysis - Probability Analysis Adv | A tool to analyze a hypothetical option position. Displays a probability histogram / chart with optional customizations. |

| Option Positions - Greeks Viewable | View at least two different greeks for a currently open option position. |

| Option Positions - Greeks Viewable Streaming | View at least two different Greeks for a currently open option position and have their values stream with real-time data. |

| Option Positions - Advanced Analysis | Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. |

| Option Positions - Rolling | Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. |

| Option Positions - Strategy Grouping | Ability to group current option positions by the underlying strategy: covered call, vertical, etc. Can be done manually by user or automatically by the platform. |

| Level 2 Quotes - Options | Level 2 options quotes available. |

| Screener - Options | Offers an options screener. Commonly referred to as a spread creation tool or similar. |

StockBrokers.com 2022 Overall Ranking

Here are the Overall rankings for the 15 online brokers who participated in our 2022 Review, sorted by Overall ranking.

Read Next

Explore our other online trading guides:

- Best Trading Platforms 2022

- Best Online Brokers for Beginners

- Best Day Trading Platforms

- Best Brokers for Penny Stocks

- Compare Online Brokers

Methodology

For the StockBrokers.com 12th Annual Review published in January 2022, a total of 3,075 data points were collected over three months and used to score 15 top brokers. This makes StockBrokers.com home to the largest independent database on the web covering the online broker industry.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy. Brokers also were offered the opportunity to provide executive time for an annual update meeting.

Our rigorous data validation process yields an error rate of less than .001% each year, providing site visitors quality data they can trust. Learn more about how we test.

doverphourromposs.blogspot.com

Source: https://www.stockbrokers.com/guides/optionstrading

0 Response to "Is It Easy to Get Approved for a Fidelity Options Account"

Post a Comment